Financial fraud is a serious issue that can have devastating consequences for businesses and investors alike. The ability to detect fraud early can protect a company’s reputation and financial stability. One of the most effective ways to identify financial fraud is through thorough analysis of financial statements. Financial statements provide valuable insights into a company’s financial health and can reveal red flags indicating fraudulent activity. By closely examining income statements, balance sheets, and cash flow statements, businesses can uncover inconsistencies and patterns that suggest manipulation or misreporting of financial data.

In this article, we will discuss how to detect financial fraud using financial statement analysis and the key red flags to look for when reviewing a company’s financial records.

Understanding Financial Fraud

Financial fraud refers to the intentional misrepresentation, manipulation, or concealment of financial information with the goal of misleading stakeholders, such as investors, creditors, and regulatory authorities. Fraud can take many forms, from inflating revenue figures to misclassifying expenses or concealing liabilities. The impact of financial fraud can be significant, leading to financial losses, legal consequences, and damage to a company’s credibility.

Financial statement analysis is a crucial tool in identifying fraud. By carefully reviewing the numbers and comparing them with industry norms, you can spot unusual trends or discrepancies that may indicate fraudulent activities.

The Role of Financial Statement Analysis in Detecting Fraud

Financial statement analysis involves evaluating a company’s financial reports to assess its financial health and performance. It involves examining key metrics, trends, and ratios to identify inconsistencies, anomalies, and signs of potential fraud. Here are the main steps involved in detecting financial fraud through financial statement analysis:

1. Reviewing Financial Ratios

Financial ratios are key tools used in financial analysis. They help assess the efficiency and profitability of a company and provide a snapshot of its overall financial health. By comparing financial ratios over time or against industry benchmarks, you can detect irregularities that could indicate fraudulent activity.

Common financial ratios to monitor include:

- Current Ratio: This measures a company’s ability to pay its short-term liabilities with its short-term assets. A sudden increase or decrease in this ratio may suggest manipulation of working capital.

- Quick Ratio: This is a more conservative measure of liquidity and excludes inventory. A rapid change in this ratio could indicate potential fraud.

- Debt-to-Equity Ratio: This ratio helps assess a company’s financial leverage. Unexplained increases in debt or sudden drops in equity could point to hidden liabilities or fraudulent reporting.

2. Analyzing Revenue Recognition

Revenue recognition is a key area where fraud often occurs. Manipulating revenue is one of the most common fraudulent practices, as it directly impacts a company’s profitability. When reviewing financial statements, pay close attention to how revenue is recognized and whether it aligns with accounting standards such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Red flags to look for:

- Sudden spikes in revenue without a corresponding increase in sales or operational activity.

- Unusually large amounts of revenue recognized at the end of the reporting period.

- Unexplained changes in accounting policies related to revenue recognition.

3. Examining Expense Classification

Another area where fraud may occur is in the classification of expenses. Some companies may try to manipulate their financial statements by misclassifying operating expenses as capital expenditures or by delaying expense recognition. This can make a company appear more profitable than it truly is.

Key points to investigate:

- Inconsistencies in expense categories: For instance, if a company consistently delays expense recognition, it can artificially inflate profitability.

- Changes in depreciation methods: A sudden change in the method of depreciation can be a red flag, especially if it’s not adequately explained.

- Underreporting of expenses: Look for discrepancies between reported expenses and industry norms, as this can indicate that expenses are being deliberately underreported.

4. Evaluating Cash Flow Statements

The cash flow statement provides a clear picture of a company’s cash inflows and outflows. It helps to highlight discrepancies between reported profits and actual cash generation. A healthy business should generate sufficient cash flow to cover its operations, investments, and financing activities.

Red flags to watch for:

- Negative cash flow despite positive profits: If a company reports profits but has negative cash flow, it may be a sign that revenue is being manipulated or that the company is facing financial distress.

- Inconsistent cash flow trends: Abrupt fluctuations in cash flow can signal fraud or financial manipulation.

- Cash flow from operations being unusually low: A company with strong sales and profitability should generally generate positive cash flow from operations. If this is not the case, it could indicate that sales are not as strong as reported or that there is fraudulent activity in the books.

5. Looking for Related Party Transactions

Related party transactions are transactions between a company and individuals or entities with close ties to the company, such as family members, major shareholders, or executives. While these transactions are not inherently fraudulent, they can be used to manipulate financial statements or conceal fraudulent activities.

Key red flags include:

- Large transactions with related parties that do not seem to have a clear business purpose.

- Lack of transparency in the terms of related party transactions.

- Unusual or favorable terms offered to related parties that benefit the individuals involved, rather than the company.

6. Comparing Financial Statements Over Time

One of the most effective ways to detect financial fraud is by comparing financial statements over multiple periods. By identifying inconsistencies or sudden changes in key figures, you can spot potential manipulation or fraud.

Look for:

- Sudden shifts in financial performance: If a company’s financial performance changes dramatically from one period to the next without a clear explanation, this could indicate fraudulent activity.

- Trends that deviate from industry norms: Compare the company’s financial performance to that of similar businesses in the industry. Significant deviations from industry averages may suggest that something is amiss.

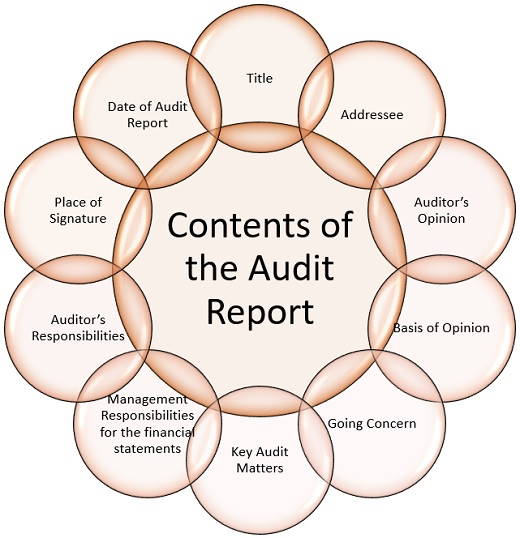

7. Auditor’s Report and Notes

Financial statements are typically audited by external auditors to ensure accuracy and compliance with accounting standards. The auditor’s report can provide valuable insight into whether the company’s financial statements are reliable.

Key things to consider:

- Qualified or adverse audit opinions: If the auditors express any reservations about the company’s financial statements, it could be a sign of potential fraud.

- Unexplained changes in auditors: If a company switches auditors frequently, it may be a red flag, as auditors who uncover fraud may be replaced by management.

Conclusion

Detecting financial fraud is critical to protecting your business or investment. By thoroughly analyzing financial statements and looking for red flags such as unusual revenue recognition, misclassification of expenses, and discrepancies in cash flow, you can identify potential fraudulent activities early. Financial statement analysis is a powerful tool that helps reveal hidden fraud and ensure that businesses operate transparently. Companies must prioritize integrity in their financial reporting to maintain trust and avoid legal and financial consequences. With a diligent approach to financial statement analysis, you can minimize the risk of falling victim to financial fraud.

Leave a Reply