A cash flow statement is one of the most crucial financial statements for businesses of all sizes. It provides insight into a company’s cash inflows and outflows over a specific period, helping business owners and managers understand the financial health of the organization. While profit and loss statements are important, they do not provide a clear picture of the company’s liquidity and ability to meet short-term obligations. A cash flow statement offers a more direct look at cash management, revealing whether the company has enough cash on hand to cover expenses, pay off debts, and invest in growth. This article explores the importance of a cash flow statement, how to interpret it, and how it can be used to improve business decisions.

What is a Cash Flow Statement?

A cash flow statement is a financial report that tracks the flow of cash in and out of a business over a specified period. It reflects all cash transactions, including operating activities, investing activities, and financing activities. This statement helps businesses track their liquidity, ensuring that they have enough cash to cover essential operations and avoid insolvency.

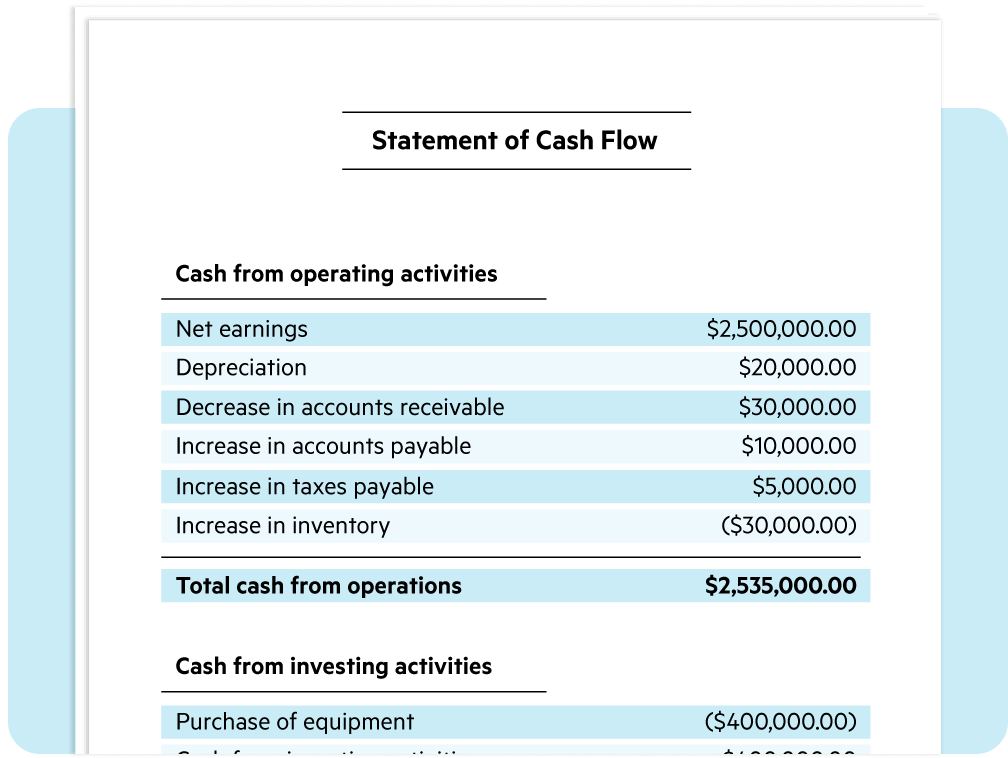

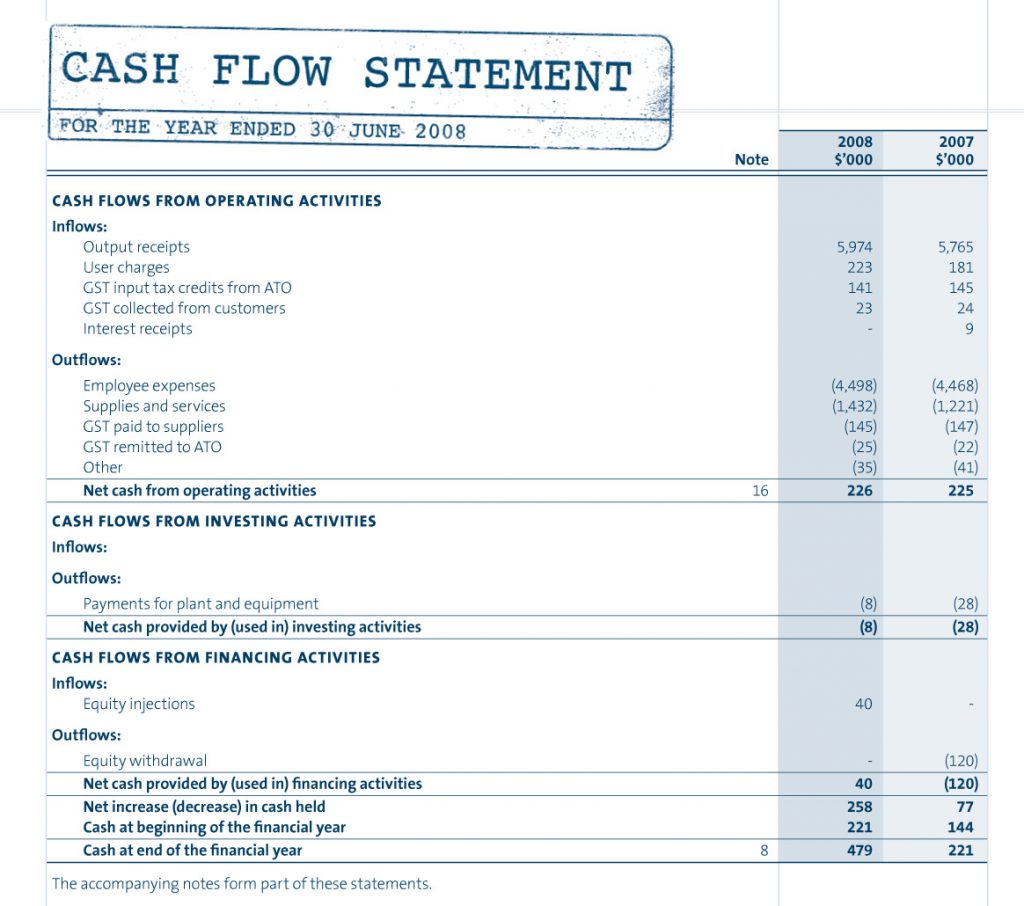

The cash flow statement is divided into three primary sections:

- Operating Activities: This section includes cash flows from the core operations of the business, such as revenue from sales, payments to suppliers, and operating expenses. It provides insight into the company’s ability to generate cash from its primary business activities.

- Investing Activities: Cash flows from the purchase or sale of long-term assets, such as property, equipment, or investments, are recorded here. This section helps determine the company’s investment strategies and long-term financial stability.

- Financing Activities: This section tracks cash flows related to the company’s financing activities, such as issuing or repurchasing stock, taking on debt, or repaying loans. It helps stakeholders understand how the company funds its operations and growth.

The Importance of a Cash Flow Statement

A cash flow statement is essential for managing a company’s financial health and ensuring its long-term sustainability. Unlike the income statement, which shows profitability, the cash flow statement reveals a company’s ability to generate cash and manage its expenses. Here are a few reasons why cash flow management is vital for businesses:

- Ensures Liquidity A cash flow statement provides a clear picture of a company’s liquidity. By tracking cash inflows and outflows, businesses can ensure that they have sufficient cash to pay their bills, cover payroll, and manage other financial obligations.

- Identifies Financial Trends Analyzing cash flow statements over time helps identify trends in cash management. A consistently negative cash flow could indicate that a business is struggling to generate enough revenue or manage its expenses. On the other hand, a positive cash flow signals that the business is operating efficiently and has the funds to invest in growth opportunities.

- Improves Financial Decision-Making Accurate cash flow reporting helps business owners and managers make informed decisions about investments, expenses, and financing. By monitoring cash flow regularly, companies can avoid taking on too much debt or investing in projects that do not provide an adequate return.

- Helps with Forecasting and Budgeting A cash flow statement is a valuable tool for financial forecasting and budgeting. By analyzing historical cash flow data, businesses can predict future cash needs and adjust their budgets accordingly. This helps in managing working capital, setting realistic financial goals, and planning for growth.

- Supports Investor Confidence Investors often look at cash flow statements when deciding whether to invest in a company. A company with strong and consistent cash flow is more likely to secure funding, as it demonstrates the ability to generate profits and manage its finances. It also helps in assessing the company’s capacity to pay dividends or repay debts.

How to Interpret a Cash Flow Statement

Understanding how to read and interpret a cash flow statement is essential for making informed financial decisions. Here’s a breakdown of each section and how to analyze the data:

1. Operating Activities

This section is the most important, as it indicates how much cash the business generates from its core activities. To evaluate this, look at the net cash flow from operating activities. A positive cash flow from operations indicates that the company is generating more cash than it is spending on day-to-day activities, which is a sign of a healthy business.

However, if the cash flow from operations is consistently negative, it may suggest that the company is struggling to generate profits, and its operations might not be sustainable without external financing.

Key metrics to consider in this section:

- Cash Flow from Operating Activities (CFO): This figure indicates how much cash the business generates from its core operations.

- Working Capital: This represents the difference between current assets and current liabilities, which can indicate short-term liquidity.

2. Investing Activities

The investing activities section helps assess how much the company is investing in long-term growth and expansion. A high level of investment may indicate that the business is reinvesting profits into its future. However, excessive spending on assets without sufficient returns could signal potential problems.

A negative cash flow from investing activities is not necessarily bad, as it may indicate that the company is purchasing assets that will contribute to future growth. On the other hand, a constant negative cash flow could indicate that the company is over-leveraged in terms of investments.

Key metrics to consider:

- Capital Expenditures (CapEx): This refers to the money spent on acquiring or upgrading physical assets, such as property and equipment.

- Asset Sales: Revenue from selling assets, which can be used to fund operations or reduce debt.

3. Financing Activities

The financing activities section reveals how the company is funded and whether it is managing its debt and equity efficiently. Positive cash flow from financing activities may indicate that the company is taking on more debt or issuing stock to raise capital. Conversely, negative cash flow could suggest that the company is repaying debt or buying back shares.

Business owners should look at whether the company is borrowing too much or relying too heavily on equity financing. While debt can be useful for expansion, excessive debt may increase financial risk.

Key metrics to consider:

- Debt Issuance or Repayment: Analyzing how much debt the company is taking on or paying off.

- Equity Financing: Cash raised through issuing stock, which can provide capital for business expansion.

Best Practices for Managing Cash Flow with a Cash Flow Statement

To effectively manage business cash flow, it is essential to regularly track and analyze the cash flow statement. Here are some best practices for optimizing cash flow management:

1. Monitor Cash Flow Regularly

Consistently review cash flow statements to identify any potential issues early. Regular monitoring will help you anticipate cash shortfalls and avoid liquidity problems.

2. Focus on Cash Flow from Operations

Prioritize increasing cash flow from your core operations. Look for opportunities to increase revenue, reduce costs, and improve operational efficiency to ensure positive cash flow.

3. Minimize Idle Cash

Avoid keeping large amounts of idle cash in the business, as it can limit growth opportunities. Instead, reinvest excess cash into profitable ventures or use it to reduce debt.

4. Plan for Future Cash Needs

Use historical cash flow data to forecast future cash requirements and plan for business expenses accordingly. This will help ensure that you have enough cash to cover obligations when they arise.

5. Control Working Capital

Efficiently manage inventory, accounts receivable, and accounts payable to optimize working capital. Keeping these elements in balance will help improve cash flow and reduce the need for external financing.

Conclusion

A cash flow statement is an essential tool for any business, providing vital insights into the company’s financial health and ability to manage its cash. By understanding how to read and interpret the statement, businesses can make informed decisions to improve liquidity, minimize risks, and ensure long-term sustainability. Regularly tracking cash flow, focusing on operational efficiency, and planning for future cash needs are all critical steps in managing business finances effectively. By using a cash flow statement, businesses can make strategic decisions that lead to growth and financial success.

Leave a Reply