A well-diversified stock portfolio is essential for achieving sustainable growth while minimizing risks. By spreading investments across different sectors, asset classes, and geographical regions, investors can protect their capital from market volatility and maximize returns. Diversification is not just about owning numerous stocks but creating a strategic mix that aligns with your financial goals and risk tolerance.

This guide explores the best practices for building a diversified portfolio to foster long-term stability and growth. Whether you’re a seasoned investor or just starting, these insights will help you make smarter financial decisions.

1. Understand the Core Principles of Diversification

Diversification involves distributing investments across various assets to reduce exposure to a single stock or sector’s performance. The concept works on the principle that not all investments respond to market conditions in the same way.

By including a mix of growth stocks, dividend-paying companies, and stable blue-chip shares, you can balance risk and reward. For instance, while technology stocks may offer high returns, they can be volatile. Adding defensive stocks from sectors like healthcare or utilities helps cushion against sudden market downturns. Diversification minimizes risks without compromising the potential for profit.

Key Tips for Beginners:

- Avoid putting all your money in a single sector or stock.

- Balance your portfolio with assets that perform differently under various market conditions.

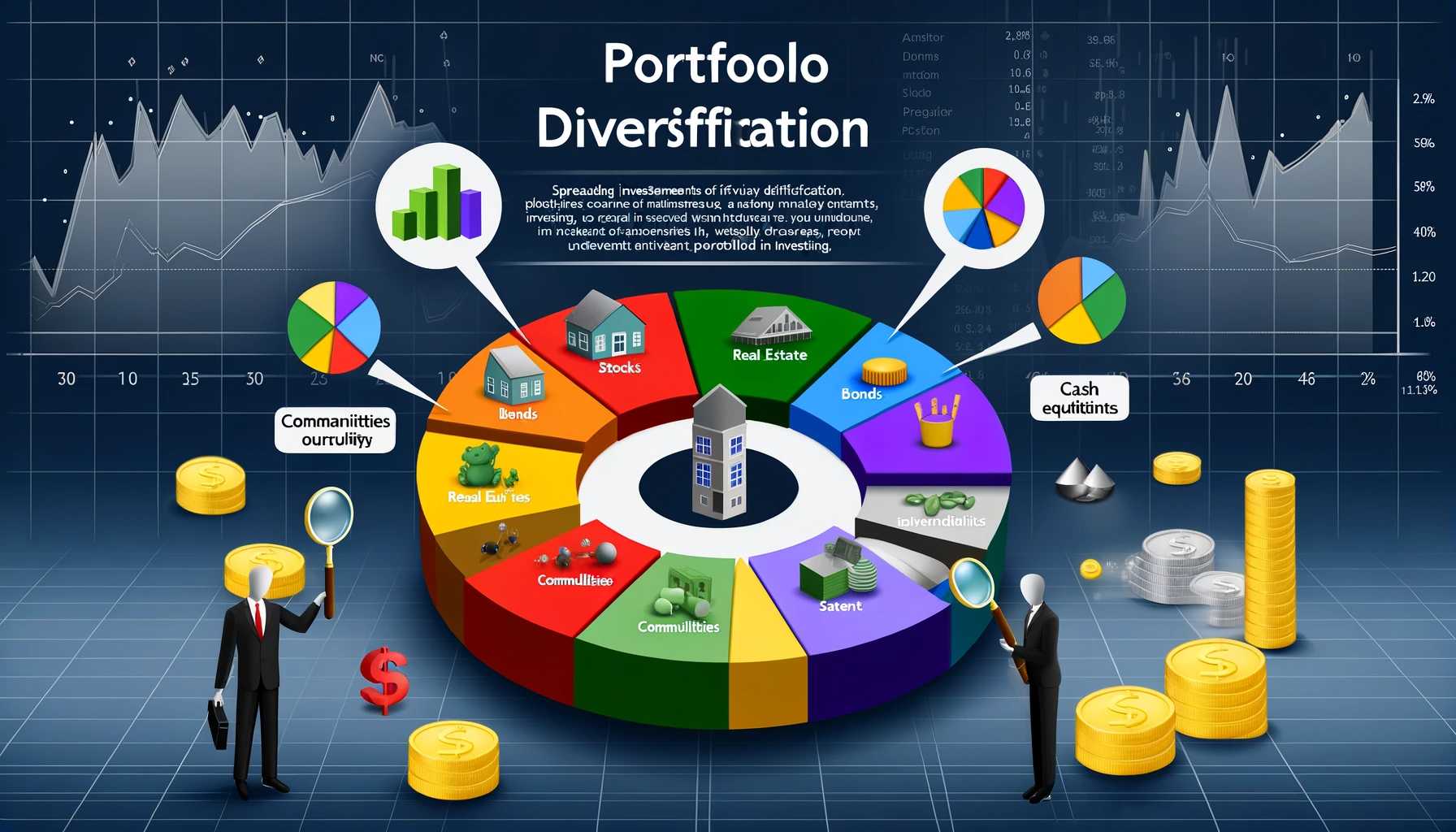

2. Expand Across Asset Classes

While stocks are a popular investment choice, diversifying across asset classes is equally important. Combining equities with bonds, real estate, and commodities can provide stability and reduce the impact of market fluctuations.

For example, when stock markets are underperforming, bonds typically offer steady returns, balancing your portfolio’s overall performance. Similarly, investing in gold or other commodities can act as a hedge during inflationary periods. Exchange-traded funds (ETFs) are an excellent option for gaining exposure to multiple asset classes without directly managing individual investments.

Strategies to Diversify Asset Classes:

- Allocate a percentage of your portfolio to non-equity investments.

- Consider alternative assets such as REITs (Real Estate Investment Trusts) for exposure to property markets.

3. Geographical Diversification Is Crucial

Limiting investments to one country exposes your portfolio to localized risks like economic instability, currency fluctuations, or political events. By diversifying internationally, you can tap into global opportunities and hedge against domestic market downturns.

Emerging markets, such as India, Brazil, and Southeast Asia, often exhibit faster growth rates, offering attractive returns. On the other hand, established economies like the United States or Europe provide stability. International ETFs and mutual funds are cost-effective ways to gain exposure to foreign markets.

Steps to Diversify Geographically:

- Invest in global funds to access multiple economies with a single purchase.

- Balance investments between developed markets and high-growth emerging regions.

4. Incorporate Sector and Industry Diversity

Sectoral diversification ensures that your portfolio isn’t overly reliant on a single industry. Economic trends affect sectors differently; for instance, technology might thrive during economic growth, while consumer staples remain steady even during recessions.

Balancing cyclical industries (those sensitive to economic changes) like automotive or travel with defensive sectors like healthcare and utilities provides a safeguard against unpredictable market conditions. Including niche industries, such as green energy or biotechnology, can further boost growth potential.

:max_bytes(150000):strip_icc()/Cyclicalstock_final-02439ac641e2400488c2a0caa41f2798.png)

Ideas for Sector Allocation:

- Spread investments across 5–7 sectors, ensuring no single industry dominates your portfolio.

- Stay updated on market trends to identify emerging opportunities.

5. Regularly Rebalance Your Portfolio

Diversification isn’t a one-time activity; it requires regular monitoring and adjustments. As markets shift, certain investments may grow faster than others, altering your portfolio’s balance. Rebalancing ensures your investments align with your original risk tolerance and goals.

For example, if your tech stock allocation grows significantly, it could disproportionately increase your risk exposure. Selling overperforming assets and reinvesting in underweighted areas maintains diversification. Set a schedule—quarterly or annually—to evaluate and rebalance your portfolio.

Rebalancing Tips:

- Assess your portfolio regularly to ensure alignment with your investment strategy.

- Use automated tools or consult a financial advisor for efficient rebalancing.

Conclusion: Achieving Long-Term Growth Through Strategic Diversification

Diversifying your stock portfolio is essential for mitigating risks and ensuring steady growth over time. By understanding the principles of asset allocation, expanding into different asset classes, diversifying geographically, balancing sectors, and rebalancing regularly, you can create a robust investment plan tailored to your financial goals.

Which diversification strategy resonates most with you? Share your insights or learn more by exploring our website. Let’s discuss how you can achieve financial success with a well-diversified portfolio!

Leave a Reply