When it comes to car insurance, understanding the differences between comprehensive and collision coverage is essential. Both types of coverage protect you in different scenarios, but knowing which one is best for your needs can save you money and provide the right protection for your vehicle. Comprehensive insurance covers non-collision-related damages, such as theft, vandalism, or natural disasters, while collision insurance specifically covers damages from accidents involving other vehicles or objects. In this article, we’ll explore the key differences between comprehensive and collision insurance, helping you decide which one—or combination of both—is the best choice for you. Whether you’re insuring a new car or an older model, understanding these coverages will guide you in selecting the right policy for your specific needs.

What Is Comprehensive Insurance?

Comprehensive car insurance, also known as “other than collision” coverage, protects your vehicle from damages that don’t result from a direct crash or collision. This type of coverage helps pay for repairs or replacement costs if your vehicle is damaged in non-collision incidents. Some situations covered under comprehensive insurance include:

- Theft or vandalism: If your car is stolen or vandalized, comprehensive insurance will help cover the damage.

- Natural disasters: This includes damages caused by events like floods, hurricanes, tornadoes, or hailstorms.

- Falling objects: If debris falls onto your vehicle, such as tree branches or hail, comprehensive insurance will cover the cost.

- Fire and explosion: Any damages caused by fire or explosions are covered by comprehensive insurance.

- Animal collisions: If you hit an animal, such as a deer, and your vehicle is damaged, comprehensive insurance will help with the repair costs.

Comprehensive insurance helps protect your vehicle from a wide range of unpredictable events, providing peace of mind that your car will be repaired or replaced if damaged outside of your control.

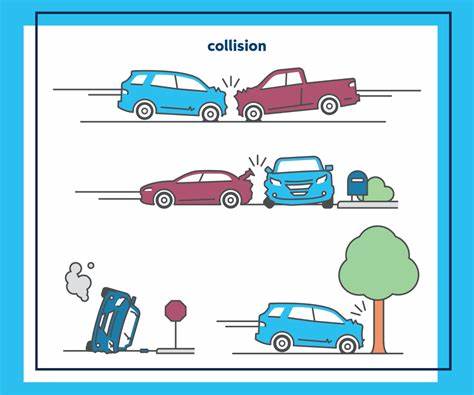

What Is Collision Insurance?

Collision insurance, on the other hand, specifically covers damages that result from a collision or accident, regardless of who is at fault. If you are involved in an accident with another vehicle or if you collide with an object like a tree, pole, or fence, collision coverage will pay for the repair costs or replacement of your vehicle. Some key points about collision insurance include:

- Accident-related damages: Collision insurance covers the cost of repairs to your vehicle when involved in an accident, no matter who is at fault.

- Damage from objects: If you hit a stationary object, like a tree, guardrail, or a parked car, collision insurance will help cover the repair costs.

- Replacement cost: If your vehicle is deemed a total loss after an accident, collision insurance can cover the replacement value of your car, depending on your policy.

Collision insurance is often a necessary coverage if you’re worried about the cost of repairs after an accident. If you’re financing or leasing your car, most lenders will require you to carry collision insurance as part of your policy.

Key Differences Between Comprehensive and Collision Insurance

Understanding the primary differences between comprehensive and collision insurance can help you choose the coverage that best suits your needs:

- Type of Damage Covered:

- Comprehensive Insurance: Covers damage caused by non-collision events, including theft, vandalism, natural disasters, and falling objects.

- Collision Insurance: Covers damage caused by direct collisions, including accidents with other vehicles or stationary objects.

- Cause of Damage:

- Comprehensive Insurance: Applies to damages caused by events that are typically outside of your control, such as storms, fires, or animal collisions.

- Collision Insurance: Applies to damages that occur during an accident, regardless of fault, and typically covers repairs or replacement costs for your vehicle.

- Cost of Insurance:

- Comprehensive Insurance: Generally cheaper than collision insurance because it covers less frequent or predictable types of events.

- Collision Insurance: Tends to be more expensive, as accidents are more common than other types of incidents, and repairs can be costly.

- Lender Requirements:

- Comprehensive Insurance: Lenders may require comprehensive coverage for new or leased cars to protect against theft or natural disasters.

- Collision Insurance: Lenders almost always require collision coverage if you’re financing or leasing your car, as it protects their investment.

- Deductibles:

- Both comprehensive and collision insurance have deductibles, which are the amount you must pay out-of-pocket before your insurance kicks in. You can choose higher or lower deductibles based on your needs. Typically, collision insurance may have higher deductibles than comprehensive coverage.

Should You Choose Comprehensive, Collision, or Both?

When deciding whether to opt for comprehensive, collision, or both types of insurance, it’s important to assess your car’s value, your driving habits, and your budget. Here are some factors to consider:

1. Vehicle Age and Value:

If you own an older car, its value may not justify the cost of both comprehensive and collision insurance. In such cases, you might choose to drop one or both coverages. However, if your car is relatively new or has a high value, both types of coverage will provide you with the protection you need in case of accidents or other unpredictable events.

2. Driving Environment:

If you live in an area prone to severe weather conditions, such as hailstorms, floods, or wildfires, comprehensive coverage becomes more important. On the other hand, if you frequently drive in high-traffic areas or on highways where accidents are more likely to happen, collision coverage would be crucial.

3. Financial Risk Tolerance:

If you can afford to repair or replace your vehicle out of pocket, you might consider forgoing one or both types of insurance. However, if the cost of a major repair or replacement would be a significant financial burden, maintaining both comprehensive and collision coverage may be the best option to protect yourself.

4. State and Local Laws:

Some states require you to have liability insurance, but the need for comprehensive or collision insurance may depend on your personal circumstances or lender requirements. If you’re financing your car, your lender will likely require both types of coverage to protect their investment.

5. Premium Costs:

The cost of premiums will vary depending on the type of coverage you choose. Comprehensive coverage is typically less expensive than collision insurance, but by having both types, your premium costs will increase. Be sure to compare quotes from various insurance providers to find a policy that fits your budget while offering sufficient coverage.

When Can You Drop One or Both Types of Insurance?

If your car is getting older and its value has decreased, you may want to reassess whether comprehensive or collision insurance is still worth the expense. Here are some scenarios where you might choose to drop one or both types of insurance:

- When the car’s value is low: If your vehicle is worth significantly less than the cost of your premium, it may not make sense to continue paying for full coverage. In this case, you may opt for liability insurance and drop collision and comprehensive coverage.

- When the cost of repairs exceeds the car’s value: If your car is severely damaged in an accident and the cost of repairs is close to or exceeds the vehicle’s value, paying for collision insurance may not be worth it.

- When you have a high deductible: If you’ve chosen a high deductible and can comfortably afford to repair or replace your car, you might consider dropping collision and comprehensive coverage, particularly if the insurance premiums are no longer cost-effective.

Conclusion

Choosing between comprehensive and collision insurance depends on several factors, including the value of your car, the likelihood of an accident, and your personal risk tolerance. While both types of coverage serve different purposes, having a combination of both is often ideal for protecting yourself from the financial consequences of accidents, theft, and natural disasters. Carefully evaluate your car’s worth, driving habits, and budget before making your decision, and don’t hesitate to consult with an insurance agent to find the best policy that fits your needs. Whether you opt for comprehensive coverage, collision insurance, or a combination of both, the goal is to ensure that you are adequately protected without overpaying for unnecessary coverage.

Leave a Reply