Car insurance is a vital part of driving, offering financial protection in case of accidents, theft, or damage. For new drivers, the process of purchasing car insurance can be daunting, especially with all the different options, terms, and requirements available. Whether you’re a first-time car owner or a new driver, understanding how car insurance works is essential for making an informed decision. In this article, we’ll break down everything you need to know about car insurance for new drivers, including key factors affecting your premium, types of coverage, and tips to find the best policy for your needs.

1. Understanding Car Insurance Basics

Before diving into specifics, it’s important to grasp the fundamentals of car insurance. At its core, car insurance is a contract between you and an insurance company that provides financial protection in exchange for regular premium payments. If you are involved in an accident or your vehicle sustains damage, your insurance policy helps cover the cost of repairs, medical expenses, or legal fees.

There are several types of car insurance coverage, each offering different levels of protection. The most common types of coverage are liability insurance, collision insurance, and comprehensive insurance. Each type of coverage protects against different risks and should be carefully considered based on your needs and budget.

2. Factors That Affect Car Insurance Premiums for New Drivers

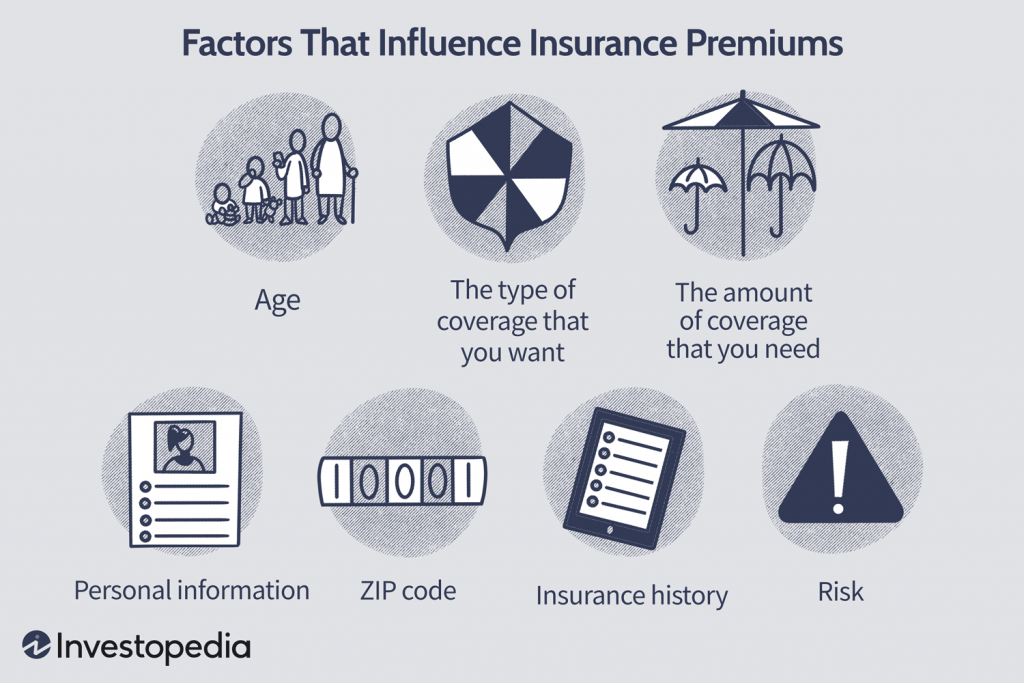

When purchasing car insurance as a new driver, understanding what affects your premium is crucial. Insurance companies assess various factors to determine the cost of your coverage. Some of the key factors include:

Age and Experience: New drivers, especially teenagers or young adults, typically pay higher premiums due to their lack of experience on the road. Inexperience increases the likelihood of accidents, which makes them riskier to insure.

Type of Vehicle: The make, model, and age of the car you drive can significantly influence your premiums. New cars, sports cars, and high-performance vehicles generally cost more to insure due to their higher repair and replacement costs. On the other hand, older cars or more economical models might result in lower premiums.

Driving History: If you have no prior driving history, insurance companies will often base your premium on general data for new drivers, which can be higher. As you gain experience and maintain a clean driving record, your premiums may decrease over time.

Location: The area where you live plays a role in determining your insurance premium. Drivers living in high-crime areas or locations with heavy traffic may pay more due to the higher risk of accidents or theft.

Credit Score: In many states, your credit score can impact your insurance rate. A higher credit score typically results in lower premiums, as it’s seen as an indicator of financial responsibility.

3. Types of Car Insurance Coverage for New Drivers

For new drivers, it’s essential to understand the different types of coverage available to ensure you’re adequately protected. Here are the most common types of car insurance coverage for new drivers:

Liability Insurance: Liability insurance is mandatory in most states and covers the cost of damage or injuries you cause to others in an accident. It typically includes two components: bodily injury liability and property damage liability. This coverage helps protect your financial assets if you’re found responsible for an accident.

Collision Insurance: Collision insurance covers the cost of repairing or replacing your vehicle if it’s damaged in an accident, regardless of who is at fault. Although collision coverage is not required by law, it can be a wise choice for new drivers, especially if you have a newer or more expensive car.

Comprehensive Insurance: Comprehensive insurance provides protection against non-collision events such as theft, vandalism, natural disasters, or hitting an animal. This coverage is especially important for new drivers who want to protect their vehicles from a wide range of potential risks.

Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who either has no insurance or insufficient coverage to pay for your damages. In many states, uninsured motorist coverage is mandatory, but it’s worth considering even if it’s not required in your state.

Personal Injury Protection (PIP): Personal Injury Protection, also known as no-fault insurance, covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. Some states require PIP coverage, while others leave it as optional.

4. How to Find the Best Car Insurance for New Drivers

Finding the best car insurance for new drivers can seem overwhelming, but with some research, it’s possible to find a policy that meets both your budget and coverage needs. Here are a few tips to help you find the best car insurance policy:

1. Compare Multiple Quotes: Don’t settle for the first insurance quote you receive. Instead, get quotes from multiple insurance providers to ensure you’re getting the best deal. You can compare quotes online, use insurance comparison tools, or contact insurance agents directly for personalized quotes.

2. Look for Discounts: Many insurance companies offer discounts that can help lower your premium. Common discounts include good student discounts, safe driver discounts, or bundling your car insurance with other types of insurance (such as home or renters’ insurance). Make sure to inquire about available discounts when shopping for insurance.

3. Choose the Right Deductible: A deductible is the amount you must pay out-of-pocket before your insurance kicks in. Opting for a higher deductible can lower your monthly premium, but be sure you can afford the deductible in case you need to file a claim.

4. Consider Minimum Coverage vs. Full Coverage: New drivers often face the choice between minimum coverage (which meets the state’s legal requirements) and full coverage (which includes additional protection). If your car is older or has a lower value, minimum coverage might suffice. However, if you have a new or expensive car, full coverage could provide better protection.

5. Review Customer Service and Reputation: In addition to price, consider the insurance company’s customer service and reputation. Look for companies with good customer reviews, fast claim processing times, and a reliable track record.

5. Tips for New Drivers to Save on Car Insurance

New drivers often face high premiums, but there are several ways to reduce the cost of car insurance without sacrificing coverage. Here are a few money-saving tips for first-time drivers:

1. Drive Safely: Maintaining a clean driving record is one of the most effective ways to lower your insurance rates. Avoid speeding tickets, accidents, and other violations to demonstrate your responsible driving habits.

2. Take a Defensive Driving Course: Many insurance providers offer discounts to drivers who complete a defensive driving course. These courses teach safe driving techniques and can help reduce the likelihood of accidents.

3. Choose a Car That’s Cheaper to Insure: As mentioned earlier, the type of car you drive affects your insurance premium. Choose a vehicle that’s known for being inexpensive to insure, such as compact cars or sedans, to keep your costs down.

4. Add Your Parents to Your Policy: If you’re a young driver, adding yourself to your parents’ existing policy can help reduce your premium. This is particularly beneficial if your parents have a good driving record and have been with the same insurer for a long time.

6. Conclusion

Car insurance is an essential part of being a responsible driver, and as a new driver, understanding your options is key to securing the right coverage. By considering factors like your driving history, the type of car you drive, and your budget, you can find the best insurance policy to meet your needs. Be sure to compare quotes, look for discounts, and choose the right coverage to ensure you’re financially protected on the road. With the right car insurance, you can drive with confidence, knowing you have the support you need in case of an unexpected event.

Leave a Reply