When it comes to protecting your family’s vehicles, finding the right car insurance is essential. With so many options available, it can feel overwhelming to choose the best coverage that fits both your needs and budget. Whether you’re a first-time buyer or looking to update your current policy, understanding your options and making an informed decision is key. This guide will walk you through the factors to consider when selecting car insurance for your family, ensuring you get the right coverage at an affordable price.

Understanding Family Car Insurance Needs

For families, car insurance isn’t just about protecting one vehicle; it’s about ensuring that everyone on the road is covered. Typically, families have more than one vehicle, which can lead to higher premiums. However, many insurance providers offer multi-car discounts, allowing families to save money while still getting comprehensive protection.

Before diving into policy options, it’s important to assess the driving habits of each family member. The more time spent on the road and the number of drivers can influence your policy choice. For example, teen drivers or older family members may require additional coverage due to higher accident risks.

Types of Car Insurance Coverage for Families

When choosing insurance for your family, you need to be familiar with the types of coverage that are available. Understanding the pros and cons of each type will help you select the best policy based on your budget and driving needs.

1. Liability Coverage

Liability insurance is a must-have for any driver, as it covers the costs of injuries or property damage you cause in an accident. For families, liability coverage is critical to protect against financial losses if someone in your family is at fault in an accident. You may choose between bodily injury and property damage liability, which are often sold together as a package.

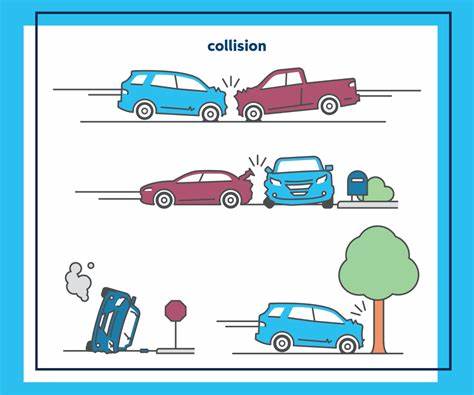

2. Collision Coverage

Collision insurance covers damage to your car in the event of an accident, regardless of who is at fault. If your family has a newer or more valuable vehicle, collision coverage can help avoid costly repairs or replacements. For families with older vehicles, it may not always be worth the additional cost, as the value of the car might not justify the premium.

3. Comprehensive Coverage

Comprehensive insurance covers non-collision incidents such as theft, vandalism, or natural disasters. For families living in areas prone to severe weather or with high crime rates, comprehensive coverage is an important option to consider. It protects against a wide range of risks that can lead to significant financial losses.

4. Uninsured/Underinsured Motorist Coverage

In case you’re in an accident where the other driver is uninsured or doesn’t have enough coverage, uninsured/underinsured motorist coverage protects you and your family. This type of coverage ensures that you’re not left with expensive medical bills or repairs when the at-fault driver lacks adequate insurance.

5. Personal Injury Protection (PIP)

PIP insurance covers medical expenses for you and your passengers, regardless of who is at fault in an accident. For families with young children or elderly members, PIP insurance can provide peace of mind, as it ensures that everyone receives timely medical care without the burden of high out-of-pocket expenses.

6. Roadside Assistance and Rental Car Coverage

While not a primary coverage, adding roadside assistance and rental car coverage can be a useful option for families. Roadside assistance can help in emergencies, such as flat tires or engine breakdowns, while rental car coverage ensures that you have transportation if your vehicle is in the shop due to an accident or damage.

Factors to Consider When Choosing Car Insurance for Families

Several factors influence the decision when choosing car insurance for your family. Here are some key elements to keep in mind:

1. Budget

Before selecting coverage, evaluate your family’s budget. While comprehensive coverage may provide the highest protection, it can also come with a higher premium. Consider what you can afford and whether certain types of coverage can be adjusted to fit within your budget.

2. Vehicle Type and Age

The age and type of vehicle your family owns can significantly affect the cost of insurance. Newer vehicles with higher market values generally require more extensive coverage. Older cars, however, may not need comprehensive or collision coverage if their value is too low. Make sure to assess the worth of each vehicle in your family to determine the best coverage.

3. Driving Habits

The driving habits of family members are crucial in determining the level of insurance coverage. For instance, if your teen driver frequently commutes long distances, you might need more coverage. On the other hand, if a family member drives a short commute to work, the insurance coverage may need less.

4. Safety Features

Vehicles with advanced safety features such as anti-lock brakes, airbags, and backup cameras can help reduce your premiums. Insurers often offer discounts for cars equipped with these technologies, as they reduce the risk of accidents. When choosing a policy, check with your insurance provider to see if your car qualifies for any safety-related discounts.

5. Claims History and Discounts

Many insurance companies offer discounts to families with a good claims history or low-risk drivers. If your family has been accident-free for several years, you may be eligible for a good-driver discount. Additionally, some insurers offer bundle deals if you insure multiple vehicles or combine home and auto insurance. Make sure to inquire about all available discounts before making your decision.

6. State Requirements

Car insurance requirements vary by state, so it’s essential to be aware of the minimum coverage required in your location. Make sure to meet the state’s legal requirements while considering additional coverage for your family’s protection. States like California and New York have specific insurance mandates, so it’s essential to understand the regulations.

7. Customer Service and Reputation

The quality of customer service is a vital aspect to consider when choosing car insurance. Look for a provider with a strong reputation for customer satisfaction, fast claims processing, and excellent support. Reading online reviews and asking friends or family for recommendations can help you find a reliable insurer that prioritizes your needs.

How to Save on Car Insurance for Families

While finding the right coverage is essential, saving money on insurance is just as important for families on a budget. Here are a few ways to lower your car insurance costs:

- Shop Around: Don’t settle for the first quote you receive. Comparing prices from different insurers can help you find a better deal.

- Increase Deductibles: Raising your deductible can lower your premium, but make sure you can afford the out-of-pocket expense if you need to file a claim.

- Take Advantage of Discounts: Look for discounts such as multi-car, good driver, or safety features discounts that can significantly reduce your premiums.

- Consider Usage-Based Insurance: If your family doesn’t drive often, consider usage-based insurance, which bases premiums on the number of miles driven.

Conclusion

Choosing the right car insurance for your family is essential for both financial protection and peace of mind. By understanding the different types of coverage and evaluating your family’s needs, you can select a policy that fits your budget while providing comprehensive protection. Be sure to shop around, compare rates, and take advantage of available discounts to get the best value. With the right coverage, you can ensure that your family stays safe and protected on the road.

Leave a Reply