Discover effective strategies for navigating the financial markets during uncertain times. Learn about risk management, asset allocation, and diversification to safeguard your investments.

Introduction

In the world of finance, uncertainty is inevitable. Economic downturns, political unrest, and unforeseen global events can all create turbulence in financial markets. For investors, these periods of instability can be unsettling, but they also present opportunities if managed wisely. In this guide, we will explore key strategies to help you navigate financial markets during uncertain times. From risk management to asset allocation and diversification, we will show you how to make informed decisions that can protect and even grow your investments when volatility strikes.

Understanding Market Uncertainty: The Impact on Financial Markets

Uncertainty in the financial markets can stem from a variety of factors: economic shocks, government policies, global conflicts, and natural disasters. When financial markets are uncertain, the prices of stocks, bonds, commodities, and even currencies can fluctuate wildly. These shifts can be stressful for investors, but understanding the root causes of these market movements is key to making well-informed decisions.

Key Insights on Market Uncertainty:

- Economic indicators, such as inflation, unemployment rates, and GDP growth, often signal market trends and help predict how markets might behave during uncertain times.

- Political instability and global events like trade wars, elections, or pandemics can significantly impact investor confidence, leading to market volatility.

- During uncertain times, it’s important to stay updated on current events that could trigger major market fluctuations.

Diversification: A Crucial Strategy in Uncertain Markets

Diversification is one of the most effective ways to protect your portfolio during periods of uncertainty in the financial markets. This strategy involves spreading your investments across different asset classes—stocks, bonds, real estate, and commodities—so that if one investment loses value, others can help offset those losses. For instance, when stock markets decline, bonds or precious metals like gold may perform better, providing balance in your overall portfolio.

Why Diversification Matters:

- Reduces risk: By holding a variety of asset types, you lower the likelihood of major losses across your entire portfolio.

- Balances returns: A diversified portfolio helps smooth out the highs and lows of the market, leading to more stable long-term returns.

- Opportunity for growth: Diversifying internationally or into alternative assets can open up growth opportunities when local markets face challenges.

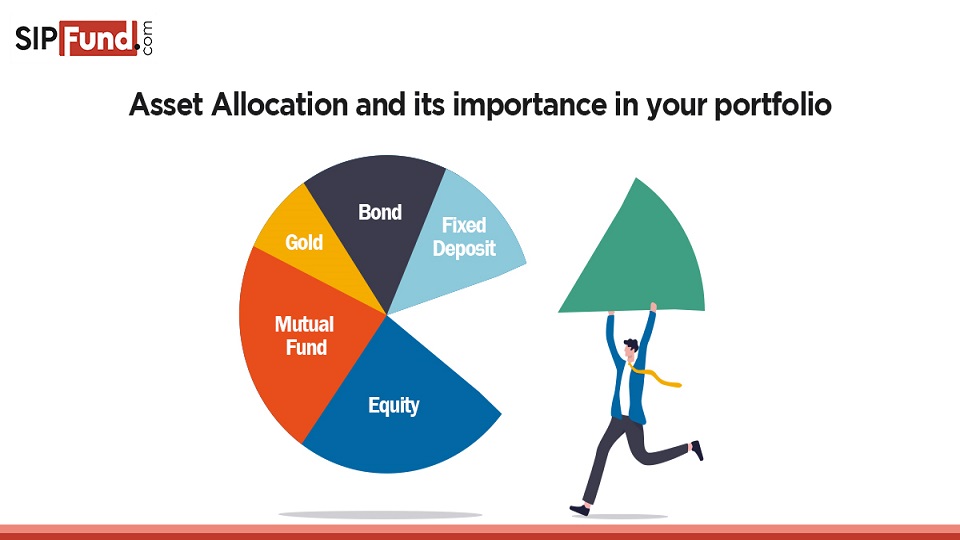

Asset Allocation: Optimizing Your Portfolio for Stability

Asset allocation is a strategy that involves dividing your investments among different asset categories to balance risk and return. In times of uncertainty, adjusting your asset allocation can help mitigate risk and better align with your financial goals. For example, during a recession, you might want to allocate more funds to bonds or defensive sectors like utilities and healthcare, which are less affected by economic downturns.

Steps to Adjust Asset Allocation:

- Assess risk tolerance: Understand how much risk you are comfortable with in relation to your investment objectives.

- Rebalance regularly: As market conditions evolve, rebalance your portfolio to maintain your desired asset allocation.

- Consider global assets: Include international stocks or bonds in your portfolio to reduce exposure to domestic market fluctuations.

Risk Management: Protecting Your Investments

Effective risk management is essential when navigating uncertain financial markets. During volatile times, having a strategy in place to limit your exposure to large losses can be a game-changer. One of the most common ways to manage risk is by using stop-loss orders, which automatically sell a security if its price falls below a certain level. Additionally, hedging with options or futures can help protect your portfolio from major downturns.

Common Risk Management Tools:

- Stop-loss orders: These orders are designed to sell an asset automatically when its price falls below a predefined level, helping to limit losses.

- Hedging strategies: Using financial instruments like options or futures to offset potential losses can help minimize risk in uncertain times.

- Safe-haven assets: Allocating part of your portfolio to safe-haven assets, such as government bonds, gold, or even certain currencies like the Swiss Franc, can help safeguard your wealth during periods of economic turmoil.

Staying Informed: The Key to Adapting to Market Changes

In uncertain financial markets, staying informed is crucial. The more knowledge you have about economic trends, market sentiment, and global events, the better prepared you will be to make strategic decisions. Regularly reviewing financial news, reading expert analyses, and utilizing investment tools that provide real-time updates can help you stay ahead of market shifts.

Tips for Staying Informed:

- Follow financial news: Keep up with the latest market developments through trusted news outlets, financial publications, and online platforms.

- Use technology: Leverage apps and financial platforms that offer real-time data and personalized alerts on market movements.

- Consult financial advisors: Professional advice tailored to your specific financial goals can help you adjust your strategy in response to shifting market conditions.

Conclusion

Navigating the financial markets during times of uncertainty can be challenging, but it doesn’t have to be overwhelming. By focusing on strategies like diversification, asset allocation, and risk management, you can reduce the impact of volatility on your portfolio and position yourself for long-term success. Stay informed, adjust your strategies as needed, and remember that uncertainty can also bring opportunities if you approach it with caution and insight.

For more in-depth guides on financial planning, investment strategies, and risk management, be sure to explore our other articles. Don’t forget to leave a comment or share your experience with us below! Try to looking for other interesting articles of vast topics in our website. Thank you for your support!

Leave a Reply